AUREXIA’s Management is delighted to announce the appointment of 3 new Partners, 3 new Associate Partners and 2 Directors, to strengthen our growth on our 9 markets in our 5 offices through Europe and APAC.

|

|

|

| Sithi Sirimanotham | Alain de Cidrac | Manmeet Rana |

|

|

|

| Nicolas Roblet – Associate Partner specialised in Finance & Risks | Alexandre Blondel – Associate Partner specialised in Investors Services | Sam Manoo – Associate Partner specialised in Data Management |

|

|

| Luc Estang Director specialised in CIB |

Geoffroy Vuatrin Director specialised in Insurance |

It is with great pleasure that we publish the November 2019 edition of Aurexia’s Regulatory Watch magazine.

November has been a very exciting month for us here at Aurexia UK. Indeed, we held our inaugural Digital Games event on the Future of Compliance, which brought together compliance professionals and fintechs to brainstorm innovative solutions for current industry issues. This reminded us of how far firms have come on data collation, data aggregation, and, lastly, data usage.

While firms continue to focus on enhancing analytics, we explore data ethics and the potential for regulatory intervention. The FCA may have delayed its Call for Input on the access and use of data in wholesale markets in September, however we predict the use of data will face increasing regulatory scrutiny over the next year.

Moreover, many firms are working at full throttle over the next few weeks, busy implementing the extension of the Senior Managers’ and Certification Regime (“SMCR”) to solo-regulated firms. We consequently explore some of the practical challenges banks still face and the key lessons learned that all firms should be considering.

Lastly, we do not claim to provide you with a complete snapshot of the regulatory news from the past month, however we have included an extract from EROS, our regulatory horizon scanning tool, with October regulatory developments.

Data ethics is becoming an important area within financial services. This is hardly surprising.

As data analytics, including intelligent and autonomous systems, play an increasingly important role in our world – for instance, transforming many different areas of our lives in profound and positive ways – these new technologies and applications pose complex ethical and economic questions that need to be addressed.

The FCA delayed their Call for Input on the access and use of data in wholesale markets in September this year. However, there are growing regulatory questions around how regulated firms are using data. This extends beyond the implications of GDPR and the use of personal data.

As the Senior Managers and Certification Regime (“SMCR”) requirements are extended to nearly all firms regulated by the FCA on 09/12/2019, we thought it would be an opportune moment to consider some of the challenges banks have faced and the subsequent lessons learned.

Therefore, it is not only the additional firms to whom SMCR will be applicable from December who are concerned. The EU branches operating in the UK have previously been subject to a lighter version, with less SMF functions applicable to them. While they transition to third country branches or subsidiaries, there will be more SMFs applicable to them and greater scrutiny.

Scanning the regulatory horizon can be a time consuming exercise. Each month, we will set out an extract of regulatory updates from our European Regulatory Oversight & Screening (“EROS”) tool. There are a significant number of publications, as you would expect. Arranged by taxonomy, the extract covers the month of September.

This – non-exhaustive – extract covers: FCA, PRA, ECB, EBA, ESMA, IOSCO, and FSB publications.

Key October highlights:

Brexit

The FCA will be extending the date by which firms and funds should notify their entry into the temporary permissions regime to 30/01/2020. Fund managers will have until 15/01/2020 to inform the FCA if they want to make changes to their existing notification. Firms should continue to comply with existing regulatory requirements (e.g. MiFID II, EMIR).

PRIIPs

The European Supervisory Authorities are promoting a consistent application by National Competent Authorities of the PRIIPs regulation to bond markets.

ESG

October was a turning point for ESG in the UK. First, the Financial Reporting Council (“FRC”) released a strengthened and revised UK Stewardship Code for 2020, based on a collaborative work with the FCA around governance and stewardship. Secondly, the FCA published their objectives and potential future actions on climate change and green finance. These objectives were in line with their strategic goal of ensuring markets function well.

It is with great pleasure that we publish the October 2019 edition of Aurexia’s Regulatory Watch magazine.

As the Brexit drama unfolds, it has been a rush to get this edition published, before we were forced to abandon our front cover. If and when Brexit happens, firms will expect a large number of changes to the UK regulatory framework.

There was a string of commitments by 130 global banks ahead of the official launch of the UN Principles for Responsible Banking at the United Nations General Assembly meeting in September. There are many more firms, including asset and wealth managers, who have signed up to the UN Principles for Responsible Investment since 2006. All are asking what sustainable finance and ESG means for them. We explore the regulatory context, key operational considerations for firms, and whether further regulatory intervention is needed.

Lastly, we do not claim to provide you with a complete snapshot of the regulatory news from the past month, however we have included an extract from EROS, our regulatory horizon scanning tool, with September regulatory developments.

There seems now, more than ever, to be a genuine interest in driving forward a sustainable agenda. We see increasing pressure from investors, but also regulators. Mark Carney, the governor of the Bank of England, recently stated “Companies that don’t adapt, including companies in the financial system, will go bankrupt without question”. Nevertheless, there are a lot of remaining challenges to ensure the current wave of enthusiasm translates into real action: definition of ESG, Brexit, conduct, data availability, or embedding codes into regulation.

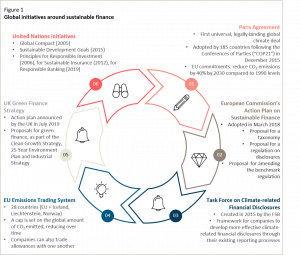

Since the adoption of the Kyoto Protocol in 1997, the world has seen a number of initiatives, at both a country and corporate level – the most important one being the 2015 Paris Agreement. Despite international commitments to keep global warming well below the 2 degrees target agreed in Paris, the CO2 stock in the atmosphere keeps rising. To meet this target, carbon emissions need to be cut by 45% by 2030 and reach net zero in 2050. Therefore, all actors – regulators, investors, corporates, financial professionals – need to push for a greater change.

ESG regulatory context since 2005

As we approach the end of October, we thought it was important to reflect on what the potential regulatory implications are, should Brexit actually happen.

Since we started on this journey back in June 2016, there has been significant concern and focus on post-Brexit planning. The industry has achieved a lot in the past three years, with new offices opening, new regulatory licences obtained, and staff hired or moved. Firms should be proud of these achievements.

Brexit provides UK regulators, particularly the FCA, with an opportunity to reconsider the regulatory framework. For the regulated business activities that will continue from the UK, the future of regulation is an important topic. There are a number of key considerations indeed, including:

– The short term priorities for UK regulators post-Brexit

– The key drivers and challenges that will impact the UK regulatory landscape post-Brexit

– The emerging trends and areas of focus we expect to dominate the UK regulatory landscape

Moreover, we will briefly explore potential impacts and considerations for the European regulatory framework once the UK leaves.

Scanning the regulatory horizon can be a time consuming exercise. Each month, we will set out an extract of regulatory updates from our European Regulatory Oversight & Screening (“EROS”) tool. There are a significant number of publications, as you would expect. Arranged by taxonomy, the extract covers the month of September.

This – non-exhaustive – extract covers: FCA, PRA, ECB, EBA, ESMA, IOSCO, and FSB publications.

Key September highlights:

Data

The FCA announced in September that it has postponed its Call for Input to explore the access and use of data in wholesale markets. However, the regulator remains committed to launching work in this area in the near future. Reports published by the Centre for Data Ethics and Innovation on ethical issues in AI are a perfect example of the importance of ethical data usage. Firms should be preparing now.

Financial Crime

Vicky Saporta, Executive Director at the PRA, wrote a ‘Dear CEO’ letter to draw attention on money laundering and terrorist financing risks, urging firms to:

– Ensure that managers have the right knowledge, skills, and experience to perform their duties

– Have robust governance arrangements

– Ensure that the FCA’s senior management responsibility for financial crime is allocated to individuals of sufficient seniority to perform their role effectively

Liquidity

There has been a number of publications on liquidity, especially regarding the asset management industry:

– The FCA issued new rules for open-ended funds investing in illiquid assets (e.g. property)

– ESMA released two publications on liquidity stress testing for investment funds

Aurexia is looking at a real use of the blockchain with the internal development and implementation of its Wallet allowing employees to exchange tokens between themselves on CSR actions in order to strengthen well-being and social capital.

Green policy for waste management, participation in charity sports activities, internal value-added work, all projects for which everyone can be rewarded with these tokens.

This Aurexia initiative paves the way for many cases of banking and insurance use.

Do you want to know more about how to implement, industrialize your blockchain projects and improve your organization? Contact us!

Comment entrer graduellement dans l’ère de l’Open Banking: Aurexia a analysé les différents modèles et perspectives offerts par l’ouverture des services bancaires de paiement.

Les possibilités sont nombreuses: partenariat des banques avec des établissements non bancaires, création de market place offrant des services bancaires, agrégation des meilleures briques fonctionnelles le long des parcours clients en selfcare ou pour les conseillers, fonctionnalités évoluées d’agrégateurs de comptes,…

Nous accompagnons nos clients dans leur réflexion stratégique autour de l’Open Banking et dans la mise en œuvre de projets dédiés

Avec leur fort taux de croissance, les néobanques et les banques en ligne dynamisent le marché de la banque de détail. Elles doivent néanmoins faire face à des enjeux majeurs liés à leur rentabilité, à la maîtrise des risques de non-conformité (KYC notamment) ainsi qu’aux risques opérationnels.

Aurexia a réalisé une analyse détaillée de l’environnement des néobanques et des banques en ligne: offres et service à valeur ajoutée, modèle opérationnel, core Banking,… Nous sommes en mesure d’accompagner des travaux sur ces différents sujets et sur les problématiques liées à la mise en conformité et au KYC

Discover our brand new study on collateral management and find out more about drivers to develop a new target model.

En pleine évolution technologique, opérationnelle et réglementaire, la banque de détail continue sa transformation.

Aurexia accompagne ses clients face à leurs principaux challenges en prenant en compte les nouvelles réglementations, l’entrée de nouveaux acteurs et la transformation digitale.

L’objectif est de s’adapter aux nouvelles tendances du marché tout en maintenant ses capacités de croissance.

In the context of market settlement operations, the European Commission introduced the Central Securities Depositary Regulation (CSDR), which provides a central point for depositing financial instruments. After the 2008 financial crisis, market settlement operations need more safety and efficiency. This European Union regulation should improve the stability and functioning of financial markets including infrastructures, clearing houses and trading venues.

Comment répondre de manière coordonnée aux besoins à la fois professionnels et privés des entrepreneurs et dirigeants d’entreprises.

Au travers de cette étude, Aurexia fait un état des lieux sur les pratiques des banques retail et banque privées pour accompagner ce segment de clientèle. Entre approche commerciale pro-active, expertises en silo et contraintes informatiques, les banques s’organisent pour répondre de manière optimale aux entrepreneurs et dirigeants d’entreprise