It is with great pleasure that we publish the October 2019 edition of Aurexia’s Regulatory Watch magazine.

As the Brexit drama unfolds, it has been a rush to get this edition published, before we were forced to abandon our front cover. If and when Brexit happens, firms will expect a large number of changes to the UK regulatory framework.

There was a string of commitments by 130 global banks ahead of the official launch of the UN Principles for Responsible Banking at the United Nations General Assembly meeting in September. There are many more firms, including asset and wealth managers, who have signed up to the UN Principles for Responsible Investment since 2006. All are asking what sustainable finance and ESG means for them. We explore the regulatory context, key operational considerations for firms, and whether further regulatory intervention is needed.

Lastly, we do not claim to provide you with a complete snapshot of the regulatory news from the past month, however we have included an extract from EROS, our regulatory horizon scanning tool, with September regulatory developments.

Sustainable Finance

Everyone is talking about it – what does it really mean?

There seems now, more than ever, to be a genuine interest in driving forward a sustainable agenda. We see increasing pressure from investors, but also regulators. Mark Carney, the governor of the Bank of England, recently stated “Companies that don’t adapt, including companies in the financial system, will go bankrupt without question”. Nevertheless, there are a lot of remaining challenges to ensure the current wave of enthusiasm translates into real action: definition of ESG, Brexit, conduct, data availability, or embedding codes into regulation.

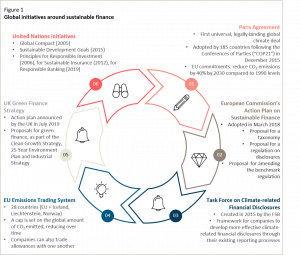

Since the adoption of the Kyoto Protocol in 1997, the world has seen a number of initiatives, at both a country and corporate level – the most important one being the 2015 Paris Agreement. Despite international commitments to keep global warming well below the 2 degrees target agreed in Paris, the CO2 stock in the atmosphere keeps rising. To meet this target, carbon emissions need to be cut by 45% by 2030 and reach net zero in 2050. Therefore, all actors – regulators, investors, corporates, financial professionals – need to push for a greater change.

ESG regulatory context since 2005

Navigating the Brexit wave

What does the future of regulation look like in the UK?

As we approach the end of October, we thought it was important to reflect on what the potential regulatory implications are, should Brexit actually happen.

Since we started on this journey back in June 2016, there has been significant concern and focus on post-Brexit planning. The industry has achieved a lot in the past three years, with new offices opening, new regulatory licences obtained, and staff hired or moved. Firms should be proud of these achievements.

Brexit provides UK regulators, particularly the FCA, with an opportunity to reconsider the regulatory framework. For the regulated business activities that will continue from the UK, the future of regulation is an important topic. There are a number of key considerations indeed, including:

– The short term priorities for UK regulators post-Brexit

– The key drivers and challenges that will impact the UK regulatory landscape post-Brexit

– The emerging trends and areas of focus we expect to dominate the UK regulatory landscape

Moreover, we will briefly explore potential impacts and considerations for the European regulatory framework once the UK leaves.

Horizon Scanning

Key regulatory highlights from the UK and global regulators

Scanning the regulatory horizon can be a time consuming exercise. Each month, we will set out an extract of regulatory updates from our European Regulatory Oversight & Screening (“EROS”) tool. There are a significant number of publications, as you would expect. Arranged by taxonomy, the extract covers the month of September.

This – non-exhaustive – extract covers: FCA, PRA, ECB, EBA, ESMA, IOSCO, and FSB publications.

Key September highlights:

Data

The FCA announced in September that it has postponed its Call for Input to explore the access and use of data in wholesale markets. However, the regulator remains committed to launching work in this area in the near future. Reports published by the Centre for Data Ethics and Innovation on ethical issues in AI are a perfect example of the importance of ethical data usage. Firms should be preparing now.

Financial Crime

Vicky Saporta, Executive Director at the PRA, wrote a ‘Dear CEO’ letter to draw attention on money laundering and terrorist financing risks, urging firms to:

– Ensure that managers have the right knowledge, skills, and experience to perform their duties

– Have robust governance arrangements

– Ensure that the FCA’s senior management responsibility for financial crime is allocated to individuals of sufficient seniority to perform their role effectively

Liquidity

There has been a number of publications on liquidity, especially regarding the asset management industry:

– The FCA issued new rules for open-ended funds investing in illiquid assets (e.g. property)

– ESMA released two publications on liquidity stress testing for investment funds